Strategies you need to know for drawing an income in retirement years

12 FEBRUARY 2018 – MORNE BEZUIDENHOUT

It is probable that many of us will live longer than our parents. From an investment point of view this poses a challenge, as the number of years spent working and accumulating capital may be fewer than the number of years spent in retirement drawing an income from that capital.

There are many strategies for drawing an income in retirement. The more conventional ones include the portfolio return, time to maturity (bucket) and flooring strategies.

The portfolio return strategy regularly draws down a percentage of the portfolio (a safe rate is 4% to 5%). The strategy invests in a diversified portfolio of cash, bonds, property and equities that are rebalanced periodically to achieve a targeted rate of return. The focus is on the entire portfolio and the investor draws from the entire portfolio over time.

Rebalancing of cash, bonds, property and equities is implemented at asset manager level. For example, should equities have outperformed, the manager may decide to reduce equity exposure in favour of one of the other asset classes.

There are several advantages to the asset manager being responsible for rebalancing, as opposed to the investor. It removes emotion in decision-making, can reduce timing risk (asset managers are able to execute quicker) and is more advantageous from a capital gains perspective.

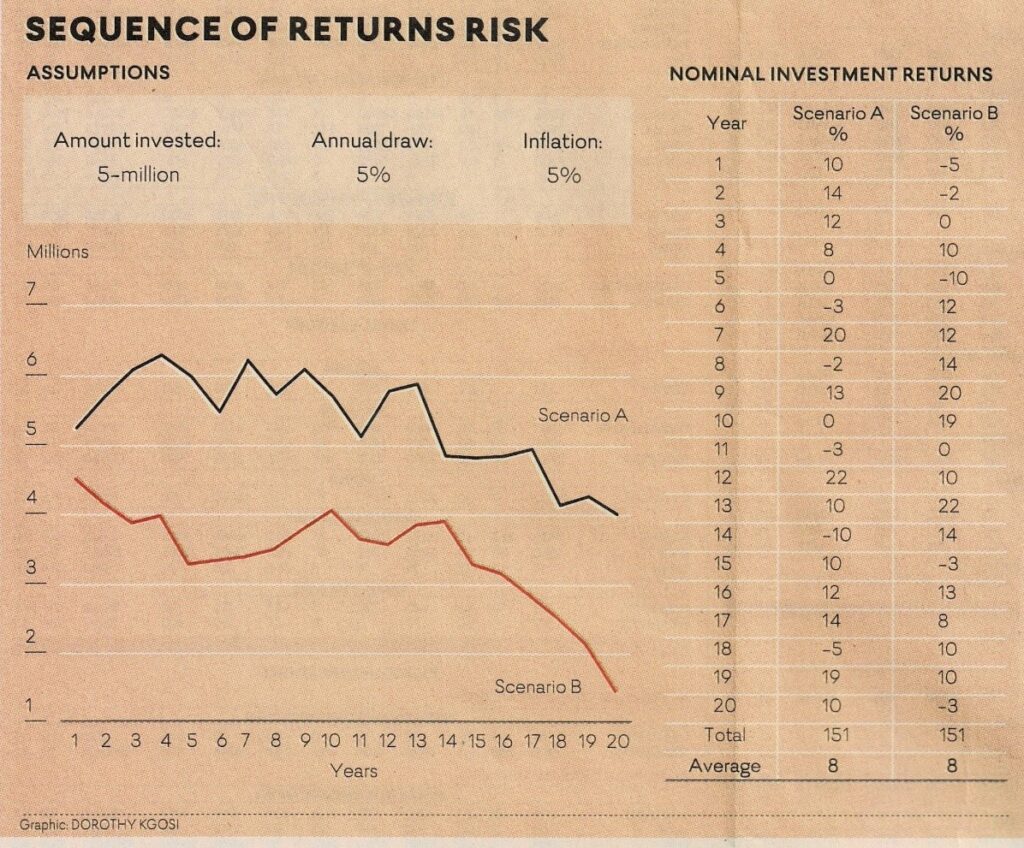

A major disadvantage of this approach is sequence of returns risk. The risk of lower or negative returns in the early stages of an investment when withdrawals are made tend to have a major effect on one’s wealth.

In the accompanying example, two investors drawing the same income achieving the same average return (8%) over the long term have very different portfolio values due to the sequence of returns.

The portfolio in scenario A is more than double that of scenario B due to good returns in the early stages.

The bucket strategy creates separate buckets of investments with lowest-risk investments in the near-term bucket, medium-risk investments in the next bucket and the riskiest investments in the long-term bucket.

Income is then drawn down from one bucket at a time, and when the capital from one bucket is depleted capital from the next bucket is used for income. Practically, an investor could decide to invest the income required over the next 12 months in a conservative strategy with little chance of capital drawdown, for example money market.

The rationale is that the risk and volatility with such a money market investment is very low and the capital is virtually guaranteed. The remainder of the investment portfolio remains invested in the medium-and long-term buckets. The bucket strategy may help investors weather the storm when markets are not behaving, as the medium-and long-term money, which are more volatile, do not need to be accessed for many years. Only funds in the money market are accessed.

The strategy can be complicated to administer. It can be costly if there are switching costs and may be less efficient from a capital gains tax perspective. There is also a reasonable degree of timing risk, as the investor will be required to make switches from the market into cash once a bucket of money is depleted.

Investors also need to think carefully how they allocate between the different buckets. There may be more spending in the initial stages of retirement (holiday and travel expenses) and later years of retirement (healthcare expenses) with less spending in the middle stages.

The most appropriate strategy will depend on an individual’s circumstances. Research indicates that on average a diversified portfolio targeting a specific rate of return gives the best results.

The flooring strategy involves classifying expenses as either essential or discretionary. Low-risk investments are used to fund essential expenses. Medium-and higher-risk investments are used to fund discretionary expenses. An example of how this might work is to allocate 70% of your assets to provide for essentials such as food, rates, taxes and medical aid. The remaining 30% may be allocated to expenses such as travel or other luxuries.

Some may want even more certainty and buy a life annuity that covers essential expenses. The drawback of this strategy is that in the current low interest rate environment it is expensive to buy the flooring to fund essential expenses.

The most appropriate strategy will depend on an individual’s circumstances. Research indicates that on average a diversified portfolio targeting a specific rate of return gives the best results. The reason is that the allocation to equities tends to be higher. Over the long term equities have produced far better returns than cash, although they have not been as smooth.

The bucket and flooring strategies tend to allocate more to conservative assets.

Of course, the results may be different should there be a long and sustained bear market, especially where the returns are poor in the early years of the investment.

You need to put enough money away for retirement, consistently from an early age. No matter how well thought through your income drawing strategy, it will not support your retirement if you have not put away sufficient savings during your career.

Speak to a professional financial planner to determine your strategy and ensure you spend less time worrying about your income and more time enjoying your retirement years.